HS and HTS Tariff Codes: categorizing the products

The HS and HTS Tariff Codes serve to better identify each type of product to facilitate imports.

This type of categorization has been implemented since 1988 by the World Customs Organization (WCO) to determine the extent of duty or tax liability of exporters and importers.

Customs operate with this classification, to simplify their clearance Do you have any idea of the huge volume of products they receive every day?

The HS and HTS Tariff Codes serve to better identify each type of product to facilitate imports.

This type of categorization has been implemented since 1988 by the World Customs Organization (WCO) to determine the extent of duty or tax liability of exporters and importers.

Customs operate with this classification, to simplify their clearance Do you have any idea of the huge volume of products they receive every day?

Why are HS and HTS Tariff Codes important?

The importance of knowing and managing these tariff codes resides in the fact that the imported products will be well documented to avoid mistakes.

For example, some countries prohibit the import of some products, due to economic policies.

How to avoid this? Review the list of HS and HTS Codes.

Sometimes tax and tariff rules benefit certain types of products.

How do you know if you will benefit from that?

Yes, by checking this famous list of HS and HTS tariff codes.

And finally, remember that countries keep track of the trade statistics of the products entering their country, so this categorization is a great help.

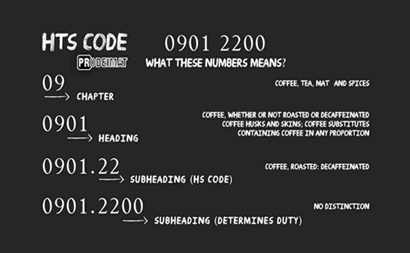

HS Tariff Code

It is known as the Harmonized Commodity Description System or Harmonized System.

These codes are usually updated every five years, the last one was in 2017.

It is a code between 6 and 10 digits that appears on commercial invoices or waybills.

And misplaced it would complicate the work of customs and generate extra costs for you due to delays in shipments.

The HS system is used to classify goods being imported into a country.

There are about 5,300 HTS codes for each product, which are divided into 97 chapters and 21 sections, which also have their headings and subheadings.

In other words:

Section >> Chapter >> Heading >> Subheading >> HS Code of product

In the latest edition of the HS nomenclature, there are 97 chapters and 21 sections.

Section Name: Animal products

- Live animals and animal products

- Products of the vegetable kingdom

- Animal or vegetable fats and oils and their cleavage products; prepared edible fats and oils and their cleavage products; animal or vegetable waxes

- Products of the food industries; beverages, spirits, liquors and vinegar; tobacco and manufactured tobacco substitutes

Section / Name: Products derived from minerals and raw materials

- Mineral products.

- Products of chemical or allied industries.

- Plastics and articles thereof; rubber and articles thereof.

- Raw hides and skins, leather, furskins and articles thereof; saddlery and harness; travel goods, handbags and similar containers; articles of animal gut (other than silkworm gut).

- Wood and articles of wood; wood charcoal and articles of wood; cork and articles of cork; manufactures of straw, of esparto or of other plaiting materials; basketware and wickerwork.

- Pulp of wood or of other fibrous cellulosic material; recovered (waste and scrap) paper or paperboard; paper or paperboard and articles thereof.

Section / Name: Products derived from minerals and raw materials

- Textile materials and articles thereof

- Footwear, headgear, umbrellas, sun umbrellas, walking sticks, canes, whips, riding-crops and parts thereof; prepared feathers and articles made of feathers; artificial flowers; articles of human hair

- Articles of stone, plaster, cement, asbestos, mica or similar materials; ceramic products; glass and articles thereof

- Natural or cultured pearls, precious or semi-precious stones, precious metals, metals clad with precious metal, and articles thereof; imitation jewellery; coins

- Base metals and articles of base metals

Section / Name: Products derived from minerals and mineral raw materials

- Machinery and apparatus, electrical equipment and parts thereof; sound recorders and reproducers, television image and sound recorders and reproducers, and parts and accessories of such apparatus

- Transport equipment

- Optical, photographic, cinematographic, measuring, checking, precision, medical or surgical instruments and apparatus; clocks and watches; musical instruments; parts and accessories of such instruments or apparatus

- Weapons, ammunition, and parts and accessories thereof

- Miscellaneous goods and products

- Works of art, collector's items and antiques

Tariff code HTS

There are also tariff codes implemented by some countries, such as HTS, which stands for Harmonized Tariff Schedule Codes.

One of the countries that use the HTS code systems the most is the United States, currently there are 17 thousand HTS codes for the identification that the U.S. makes for the merchandise that enters and leaves that country.

The HTS Tariff Schedule Code has a format where the first six digits are the same as the HS code, the remaining four are de:

- The corresponding Subheading in the U.S. system.

- The Statistical Suffix.

For example, the HST Code for an umbrella exported would be:

6603.2000

Here the first six numbers are exactly the same as the HS code, the two following numbers, 41, serve to identify the product in the North American subheading: Umbrella handles, knobs, tips and caps. And the two zeros at the end are for statistical purposes.

In conclusion, as a merchant you should know the correct classification according to the Harmonized System, which is an international requirement, and to the General Import and Export Tax Law (National) in order to avoid any affectation in customs.

Remember that we advise you and we put at your disposal the right tool and information that will help you to be sure of the tariff codes to use when classifying your products.