Understanding HTS and HS codes: What is the difference?

HTS and HS codes are essential for international trade of goods. Did you know that over 98% of the world's trade is classified under the Harmonized System (HS)? In this article, we will explain the differences between these codes and their importance to international trade.

To ensure compliance with international trade regulations, it's crucial to understand the classification of your products. For more detailed guidance, see our article on How to avoid export compliance risks. HTS and HS codes are used to classify products in international trade. Although these terms are often used interchangeably, there are important differences between them. In this article, we will explain the differences between HTS and HS codes and their importance to companies involved in international trade.

HS codes: definition and operation

What is the HS code?

HS codes play a crucial role in determining the country of origin, which is vital for understanding trade agreements and compliance. For more on this topic, read What does the country of origin of a product mean?. The HS (Harmonized System) code is a worldwide classification system for goods. It was developed by the World Customs Organization (WCO) to facilitate international trade and reduce tariff barriers. It is used by more than 200 countries around the world.

How does the HS classification system work?

Understanding how customs duties are calculated using HS codes can help businesses manage costs effectively. Dive deeper into this topic in our article on HS and HTS Tariff Codes: categorizing the products. The HS classification system is based on a six-digit structure, which represents the universal standard.

Example: Let's say you're shipping 100% cotton men's short-sleeved T-shirts. The HS code will look like this:

Category: Clothing and clothing accessories (62)

Subcategory: T-shirts, jerseys and other waistcoats (11)

Material: Cotton (42)

HS Code: 621142

With this number, customs authorities around the world are able to identify the contents of your shipment.

What are HS codes used for?

HS codes are used to classify goods in international trade. They are used by Customs to determine applicable duties and taxes, and to monitor imports and exports.

HTS codes: definition and operation

What is the HTS code?

Each country uses its own version of HTS codes to classify imported and exported products according to their description and composition.

HTS codes are used by governments to establish trade policies and protective measures for domestic industries. Importers and exporters must also use HTS codes to determine the tariffs applicable to the products they wish to import or export.

The HTS classification system is an extension of the HS code, which can be extended to eight or ten digits, and in some countries up to twelve digits, for more precise classification. The first six digits represent the universal standard, while the additional digits represent increasingly specific sub-categories.

Example:

490190: represent the universal standard HS code (six digits)

00: the country subheading

20: statistical suffix

HTS Code: 4901.90.00.20

In this code, the first six digits are the standard HS code, the last four digits of this code, which are “0020”, make it an HTS code. Here, “00”’ is the subheading and is used to establish duty rates. The last two digits, “20”, are the statistical suffix that collects trade data. It’s not used to identify the product. The statistical suffix must be correct when required, but if it’s not required it’ll be “00” by default.

Comparison between HTS and HS codes

The main differences between HTS and HS codes

The main difference between HTS and HS codes is that HTS codes are an extension of HS codes. A six-digit code is the universal standard HS code, while an eight- or ten-digit code is an HTS code.

The HTS code is often a unique number after the sixth digit and is determined by the individual importing countries. The Harmonised System also has several variants depending on the country.

How to find the HS code of your product?

To find your HS code, you can use an online database such as the one provided by the World Customs Organisation (WCO) or consult your local customs service.

HS codes are classified into categories and sub-categories, and each product or commodity is assigned to a specific category based on its characteristics. It is important to know that each country may have specific rules regarding the classification of products, so it is advisable to check with the local customs authorities to ensure that the HS code chosen is the correct one.

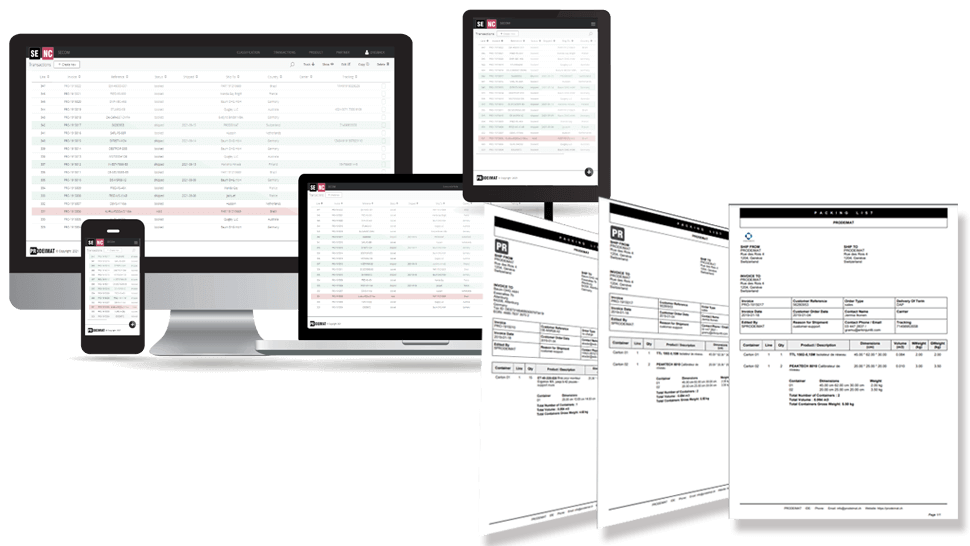

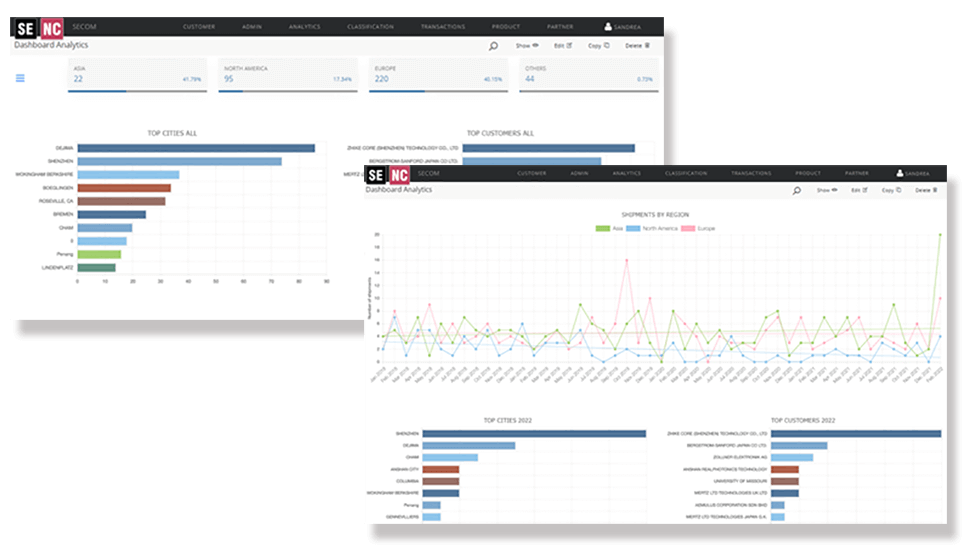

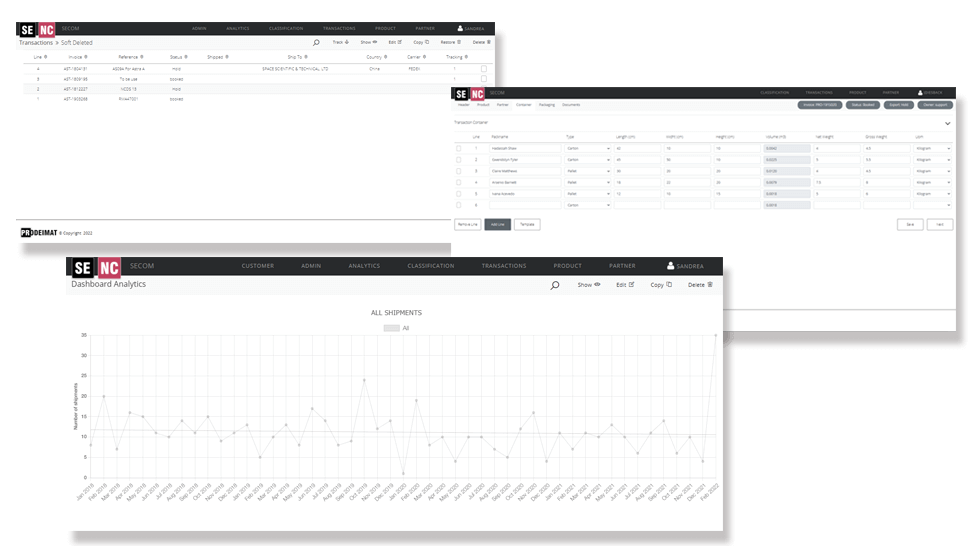

Using our automatic classification system, you can find the HS code for your product in just a few clicks. This saves you time and ensures that your product is correctly classified for international trade.

HTS and HS codes are used to classify products in international trade. HTS codes are an extension of the HS codes used by countries, which add extra digits for trade regulation and statistical purposes. It is important for companies involved in international trade to understand the differences between these two systems and to ensure that they use the correct codes for their products to avoid misclassification and problems in the customs clearance process.